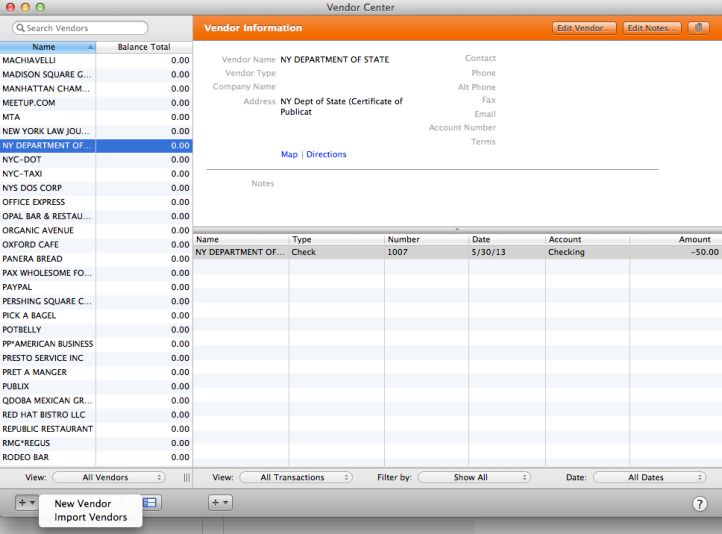

Go to Utilities, then choose Verify Data.Then, the Verify/Rebuild utility to detect the data damage. If the transaction still doesn't show up in the pay bills screen, let's ensure you have the latest version of QBDT installed. Enter the amount of your vendor's credit.On the FROM ACCOUNT column, select your Accounts Payable account.Under RECEIVED FROM, select your vendor.You'll have to make sure you select the Accounts Payable account for your deposit to record your vendor's credits successfully. Let me share additional information to help you go over your credit and apply it to your vendor bill in QuickBooks Desktop. I appreciate the steps you've performed, Wishfull2. I'll be more than happy to share some more information to help you with vendor credits. Please tap me again for any updates or if you need further help. I would still recommend checking this article for other ways to record them in QuickBooks: Record a vendor refund in QuickBooks Desktop Regardless, there are different scenarios that requires specific set of steps to account for a vendor refund. When all set, choose Pay Selected Bills, then select Done.At the lower right section, click on Set Credits and apply the Bill Credit you created earlier then select Done.Check the deposit that matches the Vendor check amount under bills to be paid.Go to the Vendors menu, then select Pay Bills.Now, we will link the two entries using the Pay Bills option. Then in the Amount column, input the appropriate amount for the account(s) you initially added.In the Expenses tab, enter the expense account you would normally use for refunds.Add the same Vendor name on the deposit we created earlier.Click on the Credit radio button to account for the return of goods.From the Vendors menu select Enter Bills.Next, let's record a Bill Credit for the amount of the Vendor Check. Fill out any important information in the Deposit.Add actual amount of the Vendor check in the Amount column.For the From Account drop-down, select an Accounts Payable account.Now, in the Make Deposits window, select the Received from drop-down and choose the vendor name who sent you the refund.Press OK if the Payments to Deposit window appears.Click the Banking menu and select Make Deposits.Thanks for reaching out back to us again, you follow the first step under Scenario 3, that deposit will create an open bill. I'll be providing some screenshots to show you the entire process, so you can review the transactions you've created.įirst, when making the deposit of the vendor check, perform these steps: Take care and have a great rest of the week. Reach out to me anytime if you still have questions or concerns with vendor refund.

#Vendor refund check quickbooks for mac free

If you need help with other tasks in QBDT for Mac, feel free to browse this link to go to our general topics with articles. The detailed steps are found in this article: Record a vendor refund in QuickBooks Desktop. I've added screenshots below to see how it looks like. Click Done and then Pay Selected Bills.

In the Apply Credits window, tick the box next to the vendor credit.Mark the deposit you've created from the list. Then, link the deposit in step 1 with the vendor credit in step 2.Create a bill credit for the same amount of your vendor check by going to Vendors, Enter Bills, and then the Credit radio button.Record a deposit of the vendor check (details are found in the article).In step 2, you'll have to record a credit to your vendor and then link it to the deposit in step 3. Good job on following step 1 in the article, you're almost there. Thanks for joining us here today, ccsmith14.

Wishing you and your business continued success. Please know that you're always welcome to post if you have any other concerns.

#Vendor refund check quickbooks for mac how to

Please also refer to this article to see steps on how to transfer available credits from one vendor to another through the use of a temporary clearing account: Transfer and apply credit from one vendor to another in QuickBooks Desktop. You can click this article to view the recommended solution on how to fix AR and AP balances on the cash basis Balance Sheet: Resolve AR and AP balances on the cash basis Balance Sheet. That's the reason you'll need to record a Bill Credit and link the Deposit. However, there are additional steps after entering a deposit to make sure your QuickBooks account balance stays accurate. Just assure you entered a reason for the refund in the description field to track it easily when reconciling your accounts. As mentioned above, you can deposit the refund and no need to enter a Bill or Bill credit. Yes, you right entering the deposit is enough. I'll provide details on why there's still another step to follow after entering a deposit while recording a refund from a vendor.

0 kommentar(er)

0 kommentar(er)